Similar to previous years, as we approach the year-end, we would like to draw your attention to the requirements for the annual certification of company commercial books.

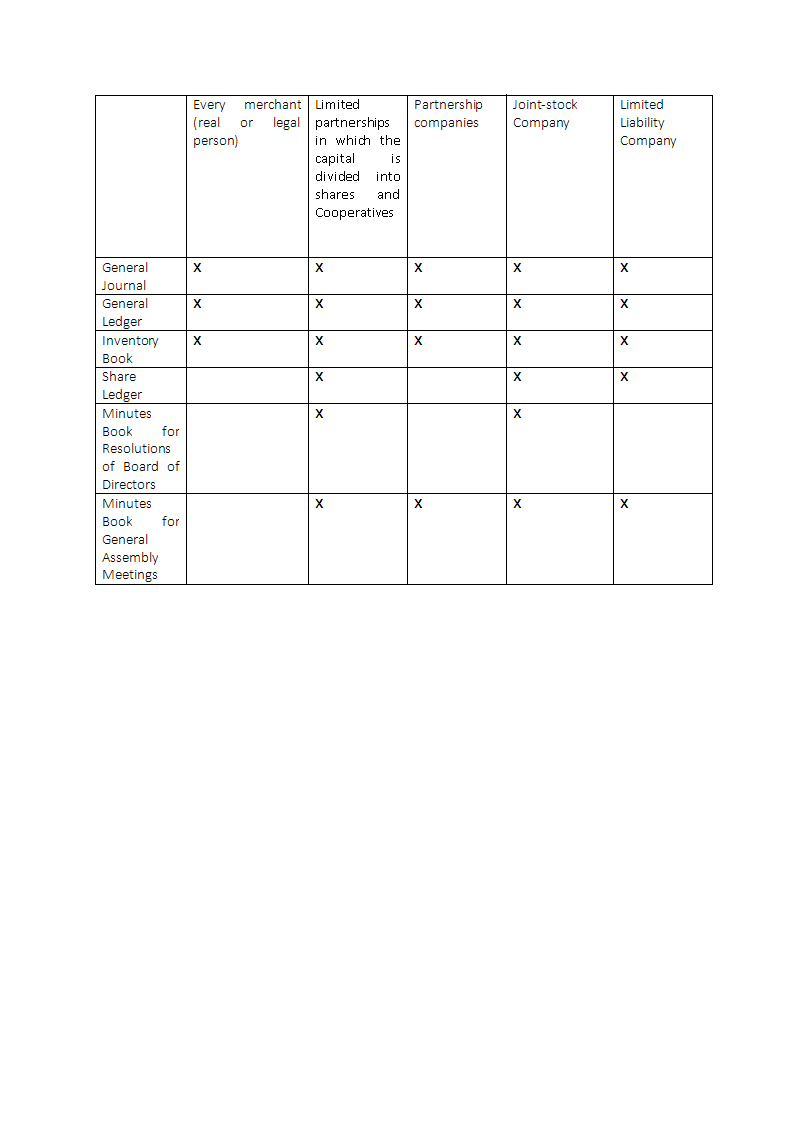

In accordance with requirements of the Tax Procedure Law and Turkish Code of Commerce, the commercial companies established in Turkey have to physically keep the following books:

- General Journal,

- General Ledger,

- Inventory Book,

- Share Ledger,

- Minutes Book for Resolutions of Board of Directors,

- Minutes Book for General Assembly Meetings

COMPANY BOOKS THAT MUST BE KEPT ACCORDING TO THE TYPE OF COMPANY

Before entering into the new activity year, please be aware of the following issues regarding the commencement and closing certifications of your company’s commercial books:

(a) Commencement certification of the Company books to be maintained physically

The commencement certification of the books kept physically by the commercial companies established in Turkey, shall have to be certified by a notary public until the end of the month preceding the company’s next activity year. Accordingly, for those companies whose accounting period coincides with the calendar year, the commercial books to be used in the year 2020 should be certified by a notary public by close of business on 31 December 2019, the last working day of the year. Although there is a new process where certification of company commercial books can be affected by the trade registries, this is applicable only during the establishment and registration of the relevant company. Therefore please be aware that companies are still required to certify the commencement of their commercial books before the notaries. Here, we would also like to point out that despite diverse practices until now, the Turkish Association of Notaries in their Circular no.22 dated 16.11.2018 has emphasized that the previous company books themselves or (in case these books have been lost) the duly issued loss certificates will also need to be submitted during the certification of new company books, be it at the year-end, or when they run out of pages.

However, the shared ledger and the minutes' book for general assembly meetings currently used by the company may continue to be used in the succeeding activity periods without any commencement certification, as long as they have a sufficient number of blank pages.

In the event the company books run out of blank pages before the end of the activity year or in the event the company is obliged to use new company books for any reason, they must obtain a commencement certification before beginning to use them.

(b) Closing certification of the company books to be maintained in a physical mode

Pursuant to the provisions of Turkish Commercial Code, closing certification is mandatory only for the general journal and the minutes' book for board resolutions.

- Closing certification for general journals may be obtained from a notary public until the end of the sixth month in the succeeding activity period (until 30 June 2020 for the taxpayers whose accounting period coincides with the calendar year)

- Closing certification for the book of board resolutions may be obtained until the end of first month in the succeeding activity period (until 31 January 2020 for the taxpayers whose accounting period coincides with the calendar year).

(c) Renewal certification of the company books

For the minutes book of board of directors’ resolutions, general journal, inventory book and general ledger, companies who wish to continue to use the same books in the following year may obtain interim approval from the notary public during the first month of the new accounting period (until 31 January 2020 for the taxpayers whose accounting period coincides with the calendar year) provided that such books have sufficient number of blank pages. In such cases, there will be no need to repeat the commencement and closing certification procedures.

(d) Penalty due to the infringement of the obligation of certification

Last but not least, we would kindly like to remind you that failure to obtain commencement and closing certifications for the company’s commercial books is subject to an irregularity fine pursuant to Article 352 of the Tax Procedure Law and also an administrative fine as per Article 562 of the Turkish Commercial Code. Furthermore, please also note that as per Article 222 of Turkish Code of Civil Procedure, unless the company’s commercial books were duly certified, recorded and maintained in compliance with the relevant laws, these books would not be deemed as acceptable evidence for the company in case of a dispute.